Playlist #4

Trading Playlist #4 – 30 March 2025:

“Here’s what the trading world was paying attention to this week. Scroll down for sentiment, charts, podcasts, macro, and more.”

“Here’s what the trading world was paying attention to this week. Scroll down for sentiment, charts, podcasts, macro, and more.”

Weekend Headlines

New York Times

-

- 10,000 Federal Health Workers to Be Laid Off

-

- Columbia President Is Replaced as Trump Threatens University’s Funding

Financial Times

-

- Idea of choosing between Trump and Europe ‘childish’, Meloni says

-

- Founder of electric truck maker Nikola pardoned after being jailed for tech lies

-

- US doubts over Nato leave F-35 jet in allies line of fire

Wall Street Journal

-

- Health Agency to cut 10,000 jobs

-

- Trump Gave Auto Executives Threat On Tariffs

-

- Baseball has a wealth-gap problem

Top Stories this week

Trump slaps 25% tariffs on auto imports – Aimed at boosting domestic manufacturing, the move raises fears of escalating trade wars.

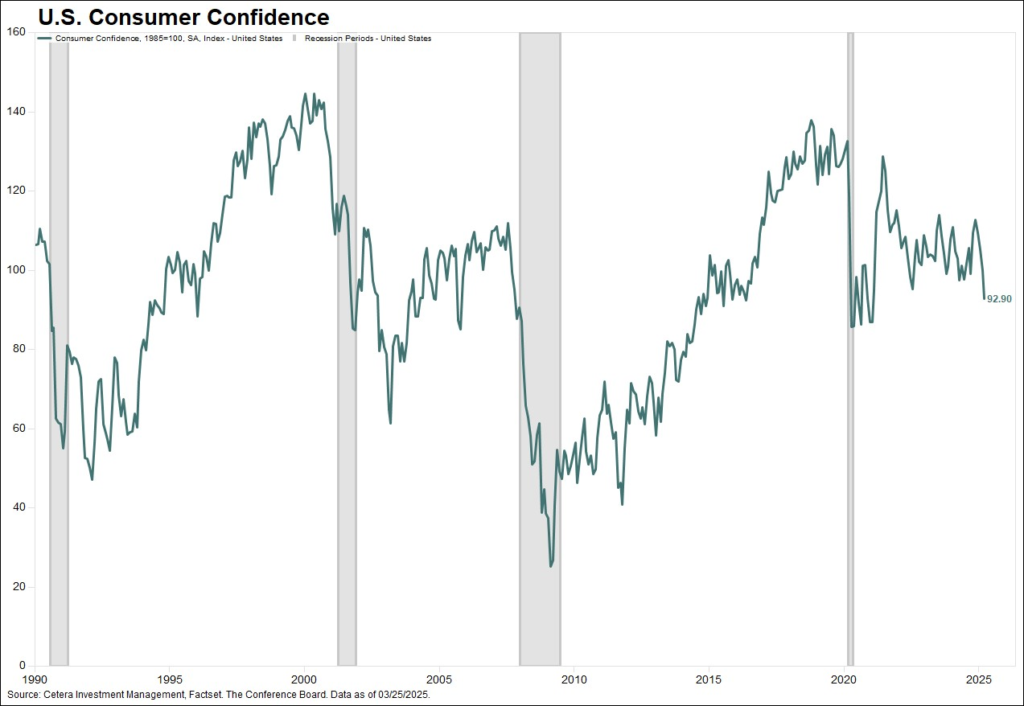

Consumer confidence hits 2-year low amid tariff concerns – Worries about inflation and job security lead to a significant drop in sentiment, impacting markets.

Extra Info

My Resource Page: Financial News Websites

Track 10# – Market Performance

(1-week price action across currencies, commodities, bonds, equities, and sectors)

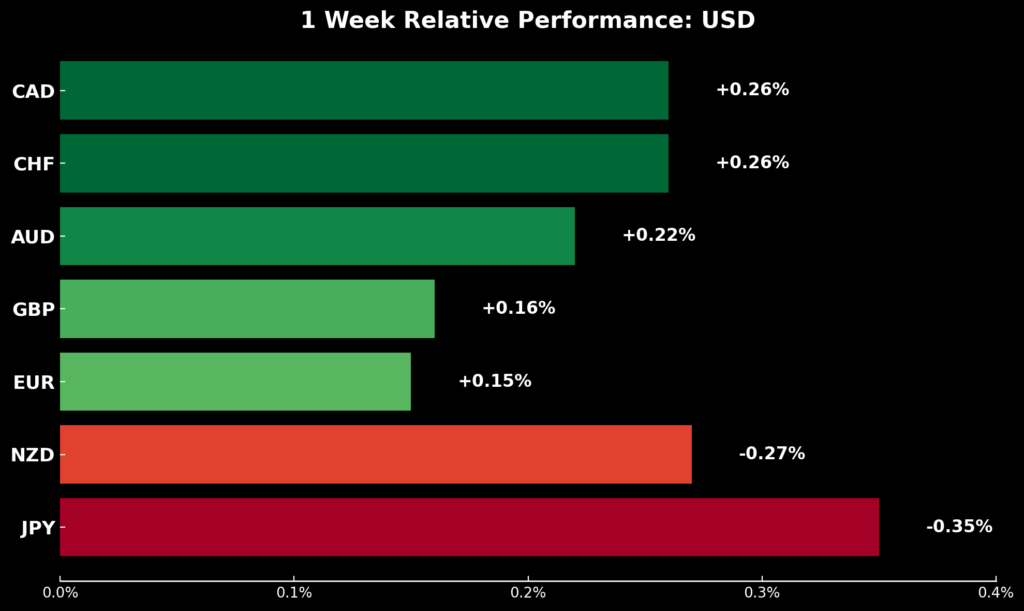

Currencies: 1 week performance

-

- On a weekly basis it was a relatively quiet week in the currency markets

-

- No major moves

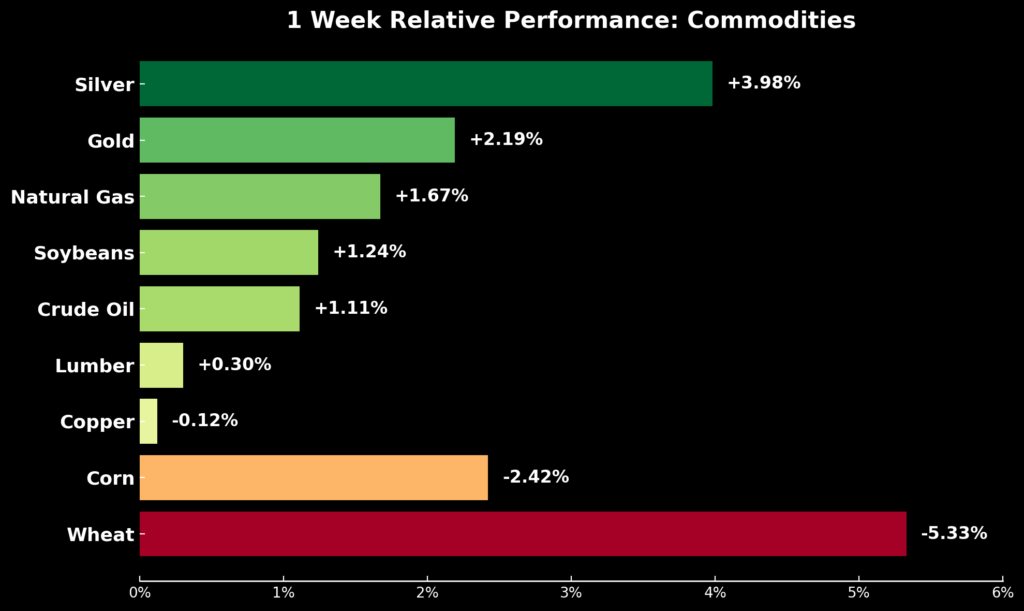

Commodities: 1 week performance

-

- Strong week for silver as markets turned “risk-off”

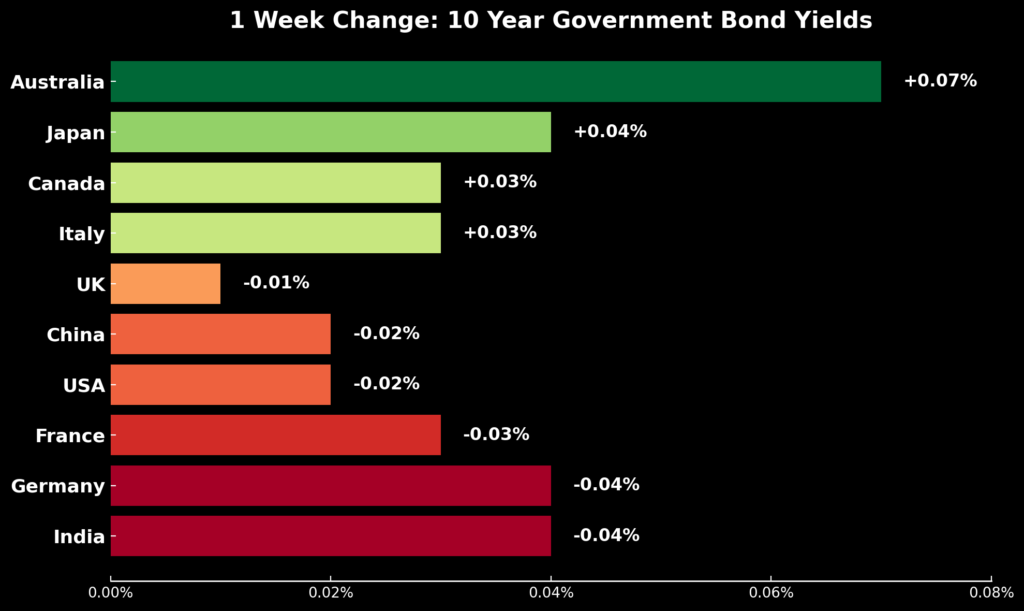

10 Year Government Bond Yield

-

- Australian bonds down the most

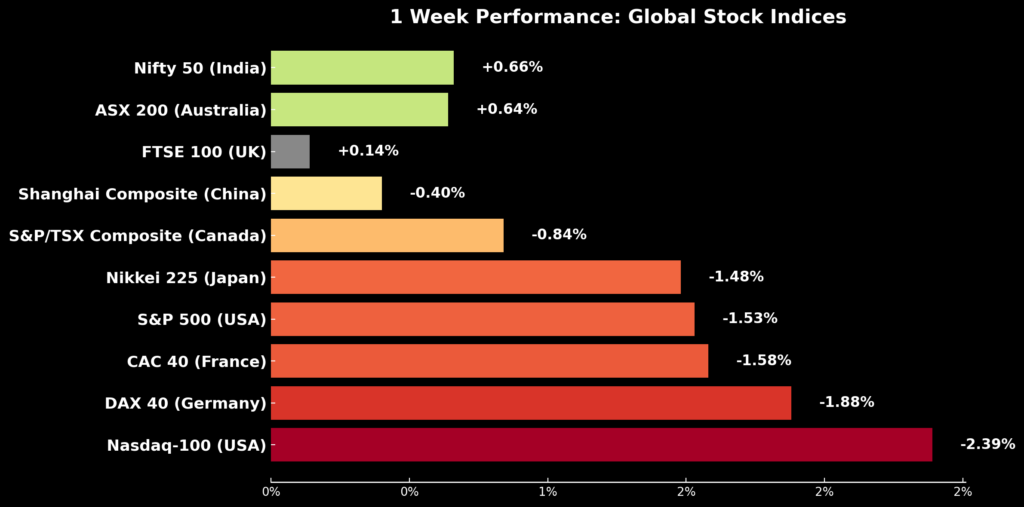

International Stock Indices: 1 week performance

-

- Same as last week with India and Australia in the 1st & 2nd spot

-

- Nasdaq down the most

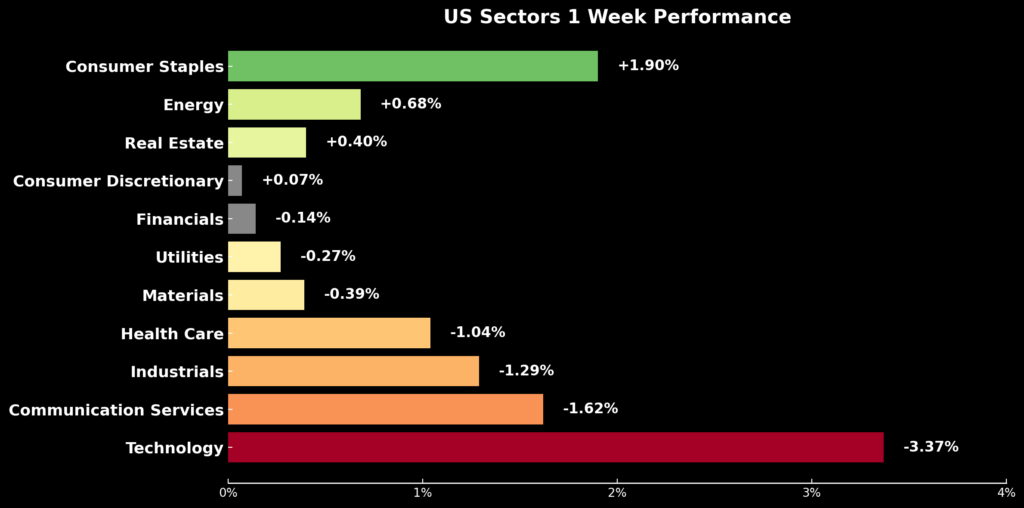

US Sectors: 1 week performance

-

- Consumer Staples up the most as market went risk-off

-

- Tech down hard with stocks like Google/Alphabet down 6%

Individual US Industry Groups

Track 9# –  Key Economic Data

Key Economic Data

Here are 5 economic releases that mattered most to the markets last week:

Extra Info

My Resource Page: Economic Data Resources

Track 8# – Market Sentiment

AAII Survey

Each week, the American association for individual investors asks their members: “Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?”

AAII Sentiment Survey

AAII Sentiment Survey

| Sentiment | This Week | Last Week | Historical Avg |

|---|---|---|---|

Bullish Bullish | 27.4% | 21.6% | 37.5% |

Neutral Neutral | 20.4% | 20.3% | 31.5% |

Bearish Bearish | 52.9% | 58.1% | 31.0% |

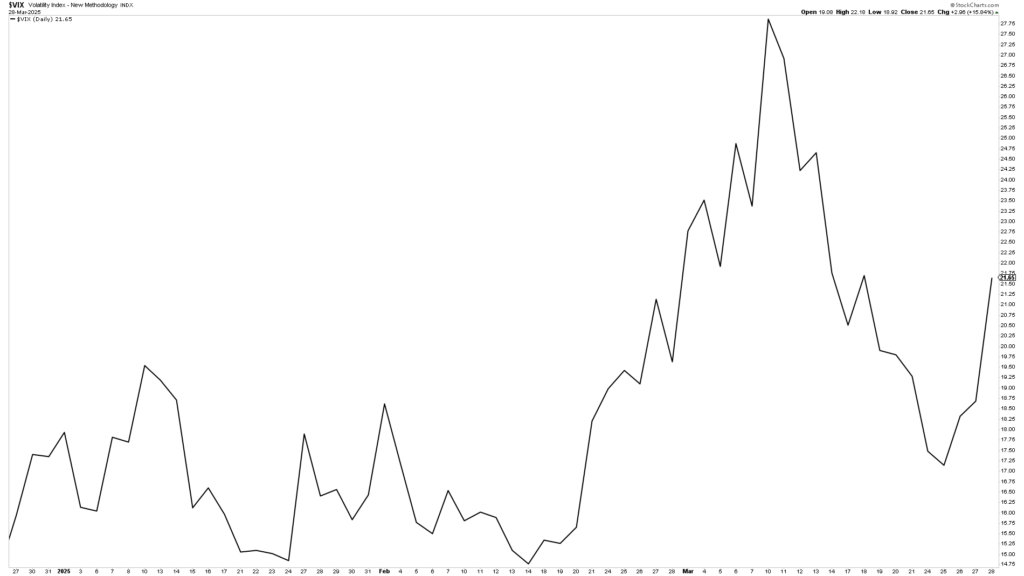

The VIX

-

- The VIX closed at 21.65

Often called Wall Street’s “fear gauge,” the VIX tracks how much volatility traders expect in the S&P 500 over the next 30 days.

-

- Higher VIX = more fear or uncertainty

-

- Lower VIX = more calm or confidence

Track 7# – The Trading Community

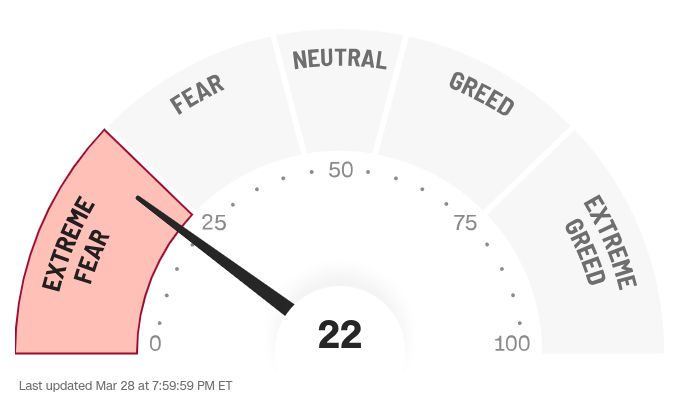

The CNN Fear/Greed index is showing extreme fear…..the only issue with using this indicator is that some of it’s components are more market momentum, that real sentiment gauges. https://edition.cnn.com/markets/fear-and-greed?utm_source=hp

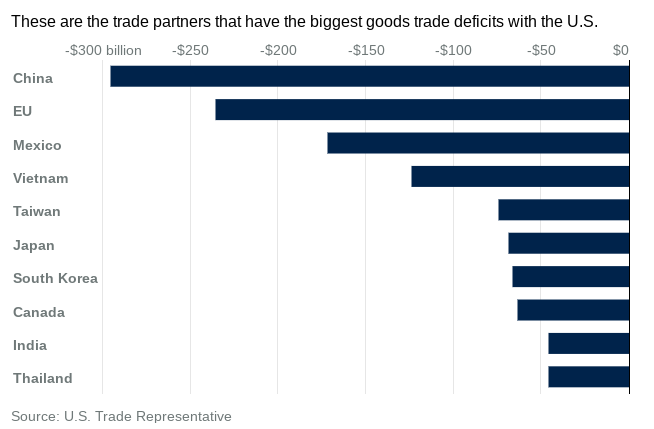

Countries with the biggest trade deficit with U.S.

Extra Info

My Resource Page: The Trading Community

Track 6# Popular Podcasts

(3 of this weeks most popular podcasts)

Topics Covered

-

- Reflexive Macro Breakdown: Julian Brigden lays out a stark macro thesis—foreigners have poured $17T into unhedged U.S. assets, fueling a reflexive cycle (strong dollar → asset buying → wealth effect → more demand). If the dollar weakens or foreigners repatriate capital, this feedback loop reverses viciously.

-

- Tariffs Are the Trigger: April 2nd isn’t a bluff. Brigden warns the administration sees tariffs not just as policy—but revenue. If countries retaliate or global trust erodes, we risk a market dislocation. He calls this “carpet bombing,” not negotiation.

-

- Everyone’s Too Long, Too Calm: Brigden sees disturbing complacency—overweight U.S. equity exposure, underpriced FX risk, and suppressed vol. If the reflexive cycle breaks or tariffs hit harder than expected, the unwind could be violent and disorderly. He’s “very, very worried.”

Topics Covered

-

- The 200-Day Moving Average as a Sentiment Trigger: Mark likens crossing below the 200-day moving average to a psychological flip—comparing it to his grandmother’s rule that “nothing good happens after midnight.” Once major indices like the S&P dip below this line, sentiment often shifts, volatility rises, and investors begin reducing risk exposure—triggering rotation across sectors and geographies.

-

- Uncertainty Is the Real Risk: The episode draws a sharp distinction between risk (quantifiable) and uncertainty (unknowable). Tariff policy, Fed indecision, and unpredictable geopolitical shifts are fueling an “uncertainty shock” that can’t be captured by volatility metrics like the VIX. This elevated uncertainty discourages investment, disrupts price discovery, and reinforces the case for trend-following strategies.

-

- Why Trend Followers May Outperform in Uncertain Regimes: Systematic strategies don’t need to predict policy—they just follow price. Mark argues that in high-uncertainty environments, trend followers thrive by adapting faster than discretionary investors, who may freeze or misread signals. With CTA beta shifting toward non-U.S. equities and gold breaking out despite falling inflation, the machines might have the edge—for now.

Topics Covered

-

- Junk bond spreads are flashing red: Tavi Costa warns that junk bond spreads falling below 3%—a level last sustained in July 2007—signals dangerous market complacency. He sees this as a potential precursor to a volatility event, similar to early signs before the Global Financial Crisis.

-

- Fed inaction could trigger deeper correction: Despite sticky inflation, the Fed appears politically motivated to stay on hold rather than cut. Costa argues this “wait-and-see” posture may accelerate a market downturn, especially as mega-cap tech and consumer discretionary stocks—market leaders for the past two years—are already in bear territory.

-

- Credit markets deteriorating beneath the surface: While junk bonds haven’t broken down yet, related markets (e.g. leveraged loan ETFs like $BKLN) are already weakening. Costa, who is short junk bonds, believes spreads are mispriced and expects a sharp repricing if equity markets drop further and the Fed delays action.

Track 5# WildCard

This section is a bit self indulgent. But ChatGPT image generation is really improving.

Who needs advertising agencies now?

Apparently I’m not the only one trying out ChatGPT’s improved image generation.

Here’s ChatGPT boss Sam Altman complaining about the insane demand they are seeing:

Inside the TRILLION-Dollar Stock Markets

I haven’t watched this yet. So don’t know if it’s any good.

But looks like something I will probably watch…

Track 4# The Bulls

Some of The Bullish Arguments…

Soft Landing Still Intact

Economic data (especially labor and consumer) shows resilience. Inflation is drifting lower without killing growth. Fed cuts still on the table = bullish cocktail.

Earnings Aren’t Breaking

Q1 earnings guidance is stable-to-upbeat. Big Tech continues to print cash, and cyclicals aren’t collapsing. No profit recession = no crash.

AI = Productivity Boom

The AI trade isn’t just hype—CapEx from Microsoft, Nvidia, etc. suggests belief in a structural economic shift. Bulls see an S-curve just beginning.

Global Liquidity is Rebounding

China stimulus, BoJ easing pressure, ECB dovish tones, and the Fed on pause—all signal net-positive global liquidity. Risk assets love this backdrop.

Market Breadth is Improving

Participation is widening beyond the Mag 7. Semis, small-caps, and even banks are catching bids. Not just a narrow tech rally anymore.

Track 3# The Bears

Some of the bearish arguments…

1. Tariffs Are Back on the Table

Trump’s 25% auto tariff plan is rattling global risk assets. Trade wars = growth wars. Supply chains fear another shock, and markets are already adjusting.

Inflation Isn’t Done Yet

Core PCE is still hot (+2.8% YoY), and progress is stalling. “Sticky” inflation kills Fed cut hopes and raises stagflation risk. That’s bad news for both bonds and stocks.

Consumers Are Cracking

Michigan sentiment just fell off a cliff. High prices and job fears are hitting wallets. Weak consumer = weak economy = lower earnings.

Valuations Are Priced for Perfection

The S&P 500 is stretched. Tech multiples are back near bubble levels. Any disappointment—earnings, rates, growth—could trigger sharp mean reversion.

Technical Cracks Are Spreading

Both the S&P 500 and Nasdaq 100 have slipped under their 200-day moving averages. Breadth is thinning. Momentum is fading. Charts don’t lie.

Track 2# – Notable Charts

Nasdaq 100

-

- The NDX100 was in an uptrend from roughly October 2022 to Feb 2025

-

- Is that uptrend now having a large pullback

-

- Something like 16500 would be a 50% retracement of the uptrend

Recreational Products

-

- The US markets made a short term low on the 13th of March

-

- Most industries are still above that

-

- But..a number have already broke lower: Gambling,clothing, footwear, durable household products, mortgage REIT’s, internet, recreational products,

Consumer stocks seem to be leading the way down. Is this just because of Trump Tariff noise. Or is this a bigger signal about consumer spending weakness

Track 1# – Next Week

What’s coming up next week…

1. Trump’s 25% “Liberation Day” Tariffs Hit (April 3)

1. Trump’s 25% “Liberation Day” Tariffs Hit (April 3)

The auto import tariffs go live Wednesday. Expect volatility in names like Ford, GM, and Tesla. With cost increases estimated at $3,500–$12,000 per vehicle, traders are bracing for potential retaliation from key trade partners.

2. Tesla Q1 Deliveries Drop (April 3)

2. Tesla Q1 Deliveries Drop (April 3)

Tesla reports Q1 deliveries Wednesday. Consensus sits around 398,000, but some forecasts are as low as 346,000—well below last year’s 423,000. A miss could tank the stock, especially with tariffs compounding EV cost concerns. A beat? Expect a relief rally.

3. March Jobs Report (April 4)

3. March Jobs Report (April 4)

Nonfarm payrolls drop Thursday, with estimates around 128,000—a clear slowdown from earlier months. Weak numbers could fuel rate-cut speculation, while traders will dissect wage growth and unemployment revisions for macro clues.

4. Fed Speakers in Focus, Powell Friday (All Week)

4. Fed Speakers in Focus, Powell Friday (All Week)

Markets will hang on every word from Barkin, Kugler, and especially Powell on Friday. Tone around tariffs, labor, and inflation will guide risk sentiment. A dovish tilt = rally risk. Hawkish stance = pressure on equities and rates.

5. Economic Data Blitz (April 1–4)

5. Economic Data Blitz (April 1–4)

A packed macro calendar includes:

-

- Monday: ISM Manufacturing PMI

-

- Wednesday: Factory Orders, Construction Spending

-

- Thursday: ADP Payrolls, Jobless Claims

These prints will shape recession chatter and short-term yield expectations.

Join the 150 Before It’s Gone

Join the 150 Before It’s Gone

TradingPlaylist is free… for now.

Once 150 traders lock in, it goes private forever.

Want in? Reserve your spot before it disappears.

Reserve Your Spot

Reserve Your Spot