Playlist #5 (Updated 20th April)

The Weekend Newsletter Built for Position Traders

Track 10# – Market News

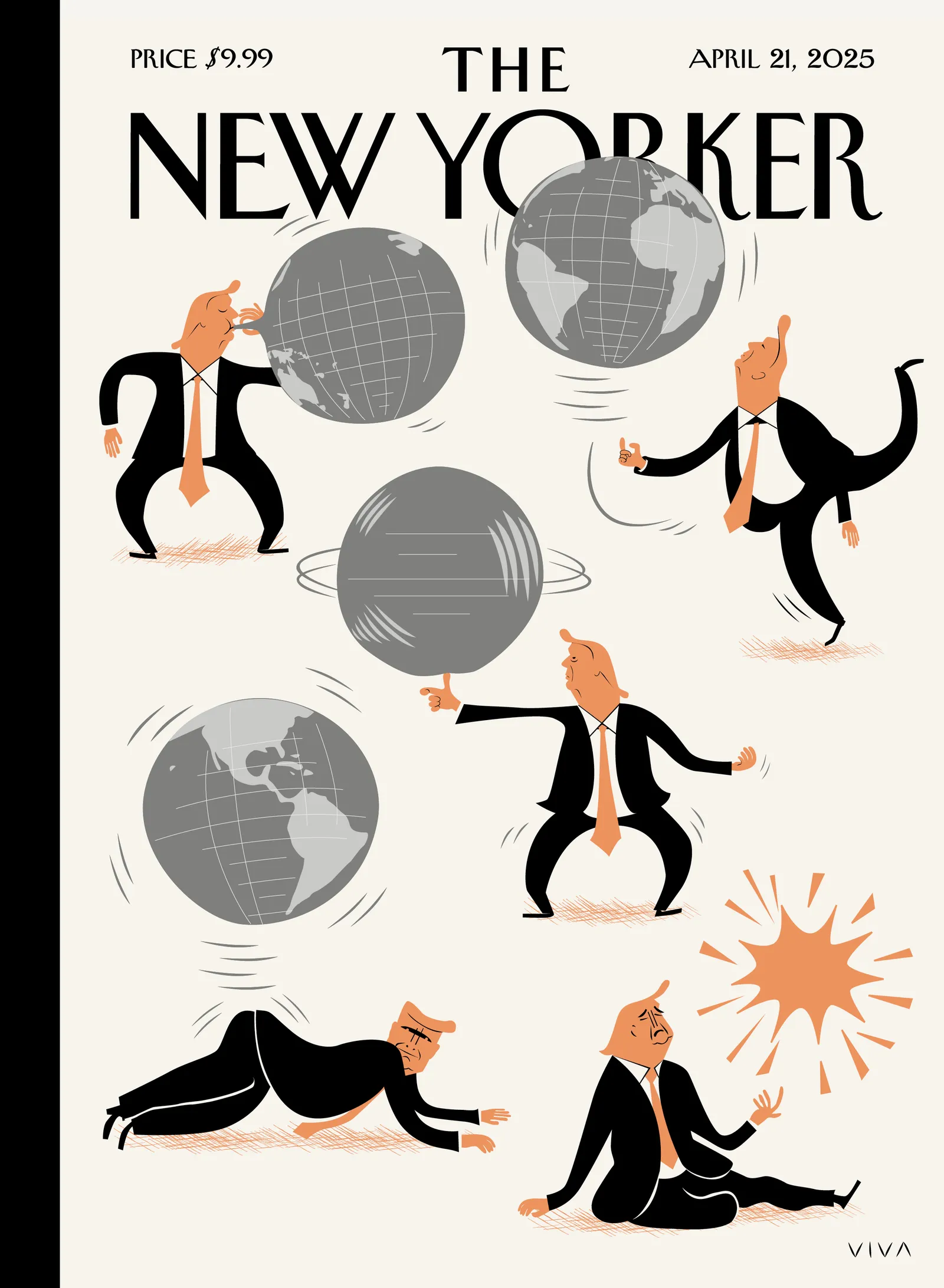

Current Magazine Covers

This weeks Highlights

– Bank of America Fund manager survey in the sentiment section.

– Market Wizard podcasts: Tom Basso, Jim Chanos

Weekend Headlines

“Every morning I read the Wall Street Journal, the Financial Times and the New York Times“

– Stanley Druckenmiller

New York Times

- Rubio Says U.S. May Quit Ukraine Cease-Fire Talks

- Tariffs Spread Fear on Bonds. For Trump, Too

- I.R.S. Leader is Ousted in Bessent-Musk Battle

Financial Times

- Defence review urges Artic build-up

- Fleeing non-doms desert private clubs fearing long arm of UK tax authorities

Wall Street Journal

- Pushback on President Mounts

- Trump Threatens To Halt Ukraine Talks

- Tomatoes Set to Be Trade-War Casualty

“When good news about the market hits the front page of the New York Times, sell.”

– Bernard Baruch

Anything Contrarian?

- The newspaper headlines are a LOT calmer than last weekend

- Is the New Yorker magazine a possible bullish contrarian signal?

*As a contrarian signal, magazine covers hit harder when they come from general-interest outlets — TIME or The New Yorker carry more weight than finance-specific ones like Barron’s.

🔐 Pro+ Extras

⇨The best financial news websites

(Includes: Global Powerhouses, Niche & Specialised)

Track 9# – Market Performance

(1-week price action across currencies, commodities, bonds, equities, and sectors)

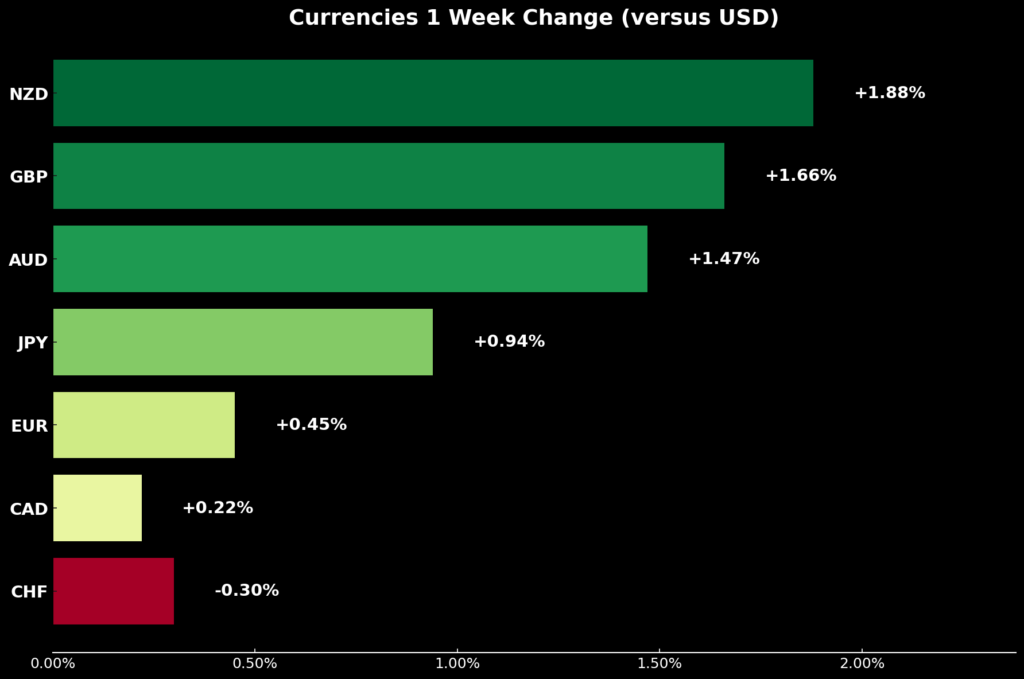

Currencies: 1 week performance

- The land of milk was the best performing currency this week

🔐 Pro+ Extras:

⇨ Market Performance for all major assets

(Including: Commodities, Bonds, Equities, Sectors & Industries)

Track 8# – 📅Key Economic Data

5 of the most important economic releases from last week

🇺🇸 Retail Sales Holding Up – Wed, Apr 16

Retail sales rose +1.4% MoM versus forecast of +1.3%

🇪🇺 ZEW Sentiment Collapse – Tue, Apr 15

German Economic Sentiment plunged to -14.0 from 51.6 in Feb

🇨🇳 China Data Beat – Wed, Apr 16

Chinese GDP was up 5.4% YoY versus forecast of 5.2%

🇬🇧 Inflation Cooling – Wed, Apr 16

UK inflation was 2.6% versus the forecast of 2.7%

🇺🇸 Philly Fed Shocker – Thu, Apr 17

This index (a survey of manufacturers) collapsed to -26.4 versus forecast of +2.2

The Gist:

- Economic data based on surveys came in real bad.

- But actual economic data not so bad.

Extra Info

Resource Page: Economic Data Resources

Track 7# – Sentiment Surveys

|

Survey |

Number |

Comment |

|---|---|---|

|

AAII |

Bulls =25.4% |

Individual investors still |

|

Investors Intelligence |

Bulls = 23.6% |

Newsletter writers very |

|

NAAIM |

Exposure =35.6% |

Investment managers |

|

BofA Fund Manager |

n/a |

Very Cautious |

AAII Survey

Each week, the American association for individual investors asks their members: “Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?”

| Sentiment | This Week | Last Week | Historical Avg |

|---|---|---|---|

| 🟢 Bullish | 25.4% | 28.5% | 37.5% |

| 🟡 Neutral | 17.7% | 12.5% | 31.5% |

| 🔴 Bearish | 56.9% | 58.9% | 31.0% |

The Gist: No surprises, individual investors are very bearish

Investors Intelligence

- Current Bulls = 23.6%

The Gist: Newsletter writers are about as bearish as they have ever been

NAAIM Survey

Exposure number = 35.6%

The Gist = Just like everyone else Investment managers are feeling defensive

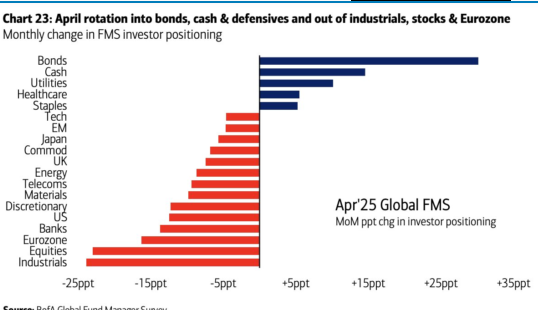

Bank of America Fund Manager Survey

- this is the big boys

Fund managers are rotating into all the defensive stuff:

– Bonds, Cash, Utilities, Healthcare, Consumer Staples

Note: the full BofA fund managers survey is available in the Pro+ section

The major surveys (and who are surveyed):

- AAII: 2-300 individual investors (weekly)

- Investors Intelligence: About 100+ independent investment newsletters (weekly)

- NAAIM: Active investment managers (number is hard to discern, could be 30-150) (weekly)

- BofA fund manager: ~200 institutional fund managers overseeing $500B+ in AUM.(monthly)

- Basically you want to think about being contrarian when these surveys are at extremes

🔐 Pro+ Extras:

⇨ Full BofA Fund Manager survey

⇨ Option Based Sentiment Indicators

(Including: VIx, Put/Call & AI generated sentiment analysis)

Track 6# – Bulls versus Bears

This week I want to highlight the views of Swiss hedge fund manager Felix Zulauf.

By Fall, Be Fully Invested”:

Felix Zulauf’s Bullish Case for 2026–2027

🧠 The Case in a Nutshell

Veteran macro strategist Felix Zulauf believes we’re in the final stage of a classic market shakeout — and positioning now could pay off big into 2026 and 2027. Short-term risks remain (a potential retest, recession odds rising), but Zulauf argues the worst is behind us. Capital is flowing home, global trade is being rewritten, central banks are quietly preparing stimulus, and sentiment is max bearish — a bottoming cocktail if there ever was one.

“By fall at the latest, you should be fully invested again for the nice ride through 2026 into 2027.”

🧩 Core Thesis: A 3-Part Framework

1. We’re in a Bottoming Phase

- The market has likely seen its 2025 lows (S&P ~4,835)

- Sentiment is extreme (BofA survey: most bearish in 25 years)

- Technicals show a washout: breadth, new lows, put/call ratios

- One more retest likely in May — but lower lows are unlikely

- Fall offers the last clean setup to reload

2. 2025 Is a Transition Year

- Expect whipsaws, failed rallies, and chop — but it’s part of the reset

- Hold cash, stay patient, and buy sharp selloffs in high-conviction sectors

- A new mini bull market could start Q4 and run through 2027

3. Reflation + Realignment Are Coming

- Trump’s tariff regime is forcing global capital realignment

- Less demand for USD, more fiscal muscle across regions

- Dollar in a multi-year decline; U.S. yields sticky from foreign outflows

- Expect rising stimulus in U.S., Europe, and China to reignite demand

🎯 What He Likes

- Industrials tied to reshoring and U.S. trade protection

- Foreign markets — especially Europe and Asia, as U.S. outperformance fades

- Emerging markets (e.g., China/Hong Kong) for brave capital

- Commodities — crude could bottom here and reach $150–200 by 2027

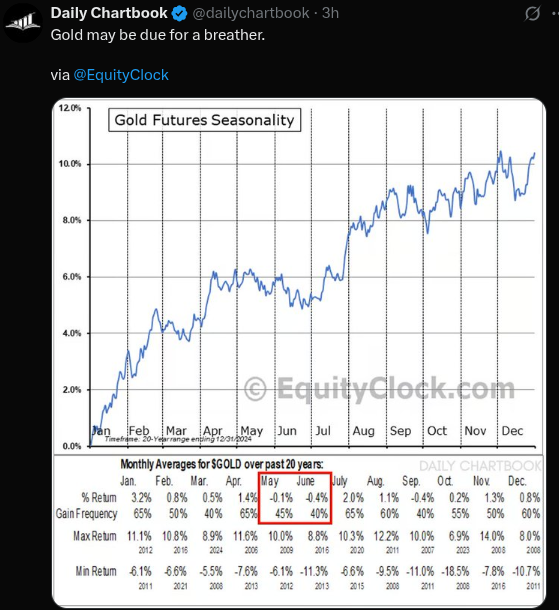

- Gold — long-term bullish due to global regime shifts, despite near-term froth

⚠️ What He’s Avoiding

- Bonds — long-term bear. Recession could lower yields briefly, but the trend is broken

- Mega-cap tech / platform stocks — AI hype is fading, and tax arbitrage models are politically exposed

- Europe (long term) — short-term stimulus bounce, but structurally fragile

💡 Cipher’s* Take

This isn’t a cheerleader rally call — it’s a timing play grounded in macro shifts and market psychology. Zulauf sees 2025 as a volatile reset, not a crash. He’s betting that the policy world won’t tolerate asset destruction — and that investors who step in during max pessimism will be rewarded.

He’s not alone in his outlook, but his confidence in timing and detail makes it stand out. While Wall Street argues about whether the selloff is “over,” Zulauf is mapping the next 24 months to S&P 7,500. If he’s right, the best buying window is this fall.

*Cipher is what my AI has decided it wants to be called 🙄

Extracted from podcast by Adam Taggart

Track 5# – Charts Traders Are Watching

Silver Stocks

Ever since the 7th of April (potential) market bottom. Gold and Silver have been some of the strongest sectors. Short term they look a little over bought. But if we see a couple of low volume down days. Bringing the stocks down some where near their 21 day moving average. There will probably be a lot of traders looking to buy the pull back.

See 5 larger charts in the pro section

🔐 Pro+ Extras:

⇨ 5 Charts traders are watching

(including: PLTR, FANG, $OIL)

Track 4# – Popular Podcasts & Videos

An Interview with Ray Dalio

Topics Covered:

Beyond the Tariffs: Dalio argues that markets are distracted by short-term noise like tariffs, while the real threat lies in the deeper breakdown of global monetary, political, and geopolitical systems — echoing patterns from the 1930s.

Debt, Imbalances, and Systemic Risk: He breaks down how unsustainable debt levels, massive trade/capital imbalances, and an aging U.S. monetary order are creating a dangerous supply-demand mismatch in bond markets that could destabilize the system.

Looming Recession & Loss of Trust: Dalio warns that recession is likely, and compares current capital market vulnerabilities to a “second COVID” event — driven by instability, distrust in U.S. policy, and the erosion of the dollar’s role as a reliable store of value.

🔐 Pro+ Extras:

⇨ 5 of the most popular podcasts this week

(including Market Wizards Jim Chanos and Tom Basso)

Track 3# – Social Media Buzz

Five things that caught my attention on social media this week:

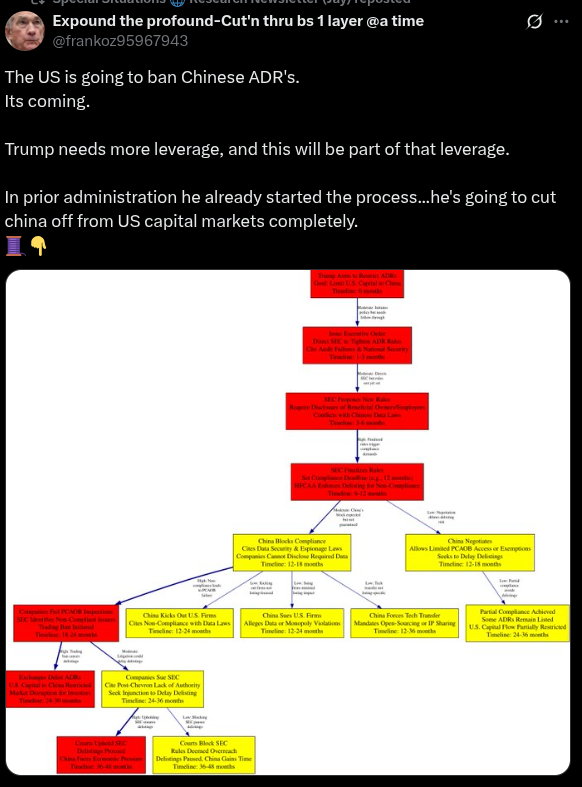

- Will the US ban access to Chinese stocks.

- Gold has been super strong lately. But seasonality suggests that it might take a breather for the next couple of months

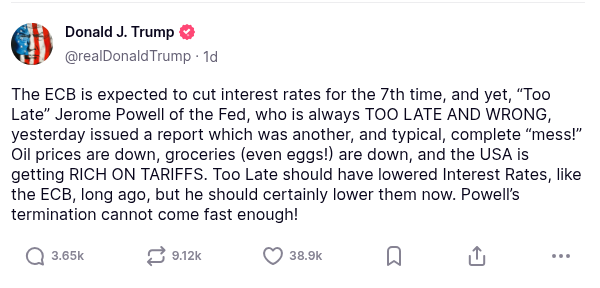

- Trump going in hard on Fed chair Powell

- Ray Dalio has been out talking about Depression lately. But here was him talking about Depression in 1992. He does talk about it a lot.

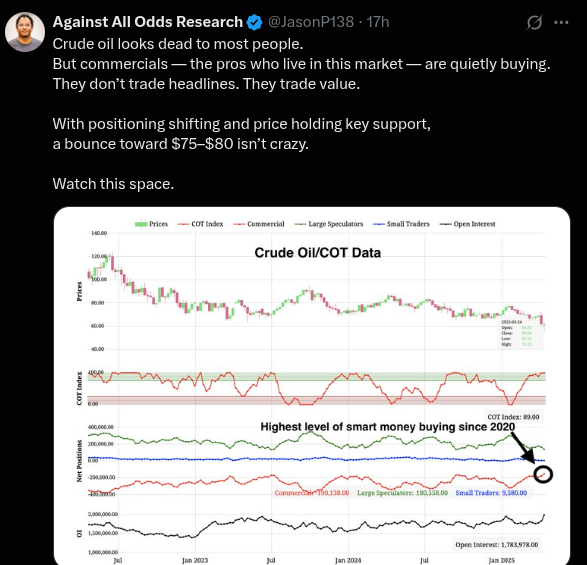

- Some traders are starting to pay attention to the energy sector

Info

Resource Page: The Trading Community

Track 2# WildCard

Interview with the Fed Chairman

📉 Powell: Growth Slowing, Inflation Sticking, Policy on Hold

Fed Chair Jerome Powell spoke in Chicago this week, and while he avoided direct guidance on rate cuts, he laid out a roadmap that matters for longer-term traders. Here’s what you need to know:

🔹 Economic Growth Is Slowing

- Q1 growth is cooling, with early data showing weaker consumer spending and softer business investment.

- High imports (possibly companies front-running tariffs) are expected to drag on GDP.

- Forecasts are shifting down, but Powell still expects positive growth — just slower.

Position Trader Angle: Slowing growth without a recession means markets could stay range-bound, with rotating leadership. Be selective — not everything will rally.

🔹 Inflation Still Above Target

- Core PCE is running at 2.6%, and Powell says progress is “gradual.”

- Tariffs could temporarily raise inflation, and potentially make it more persistent if expectations shift.

- The Fed’s main concern is avoiding a scenario where these one-time price hikes become entrenched.

Position Trader Angle: Powell thinks inflation isn’t done yet. Don’t assume we’re heading into a dovish pivot.

🔹 Tariffs Are the Wild Card

- Powell warned that tariffs = inflation + slower growth.

- Three inflation risks: 1) size of tariffs, 2) speed of pass-through, 3) inflation expectations.

- He noted the risk of supply chain disruptions (e.g., autos) dragging things out, like the chip shortage during COVID.

Position Trader Angle: Watch tariff-sensitive sectors (retail, industrials, autos). Possible long setups in U.S.-centric firms or defensive sectors. Short opportunities in globally exposed names.

🔹 Labor Market Still Strong, But Immigration Drop Is a Hidden Drag

- Unemployment is low. Wage growth is cooling. Labor supply is stable for now.

- But immigration is falling fast, which could cap future labor supply and productivity growth.

- Long-term, Powell expects this to limit upside in job creation.

Position Trader Angle: Labor market strength is keeping the Fed patient. But falling immigration = potential headwind for growth stocks dependent on cheap labor or expanding domestic markets.

🔹 No Rate Cuts Imminent — But Also No Hikes

- Powell says the Fed is well-positioned to wait.

- He sees inflation and unemployment both at risk of rising, which puts the Fed in a bind — one policy tool, two opposing forces.

- Market volatility is acknowledged, but Powell emphasized the Fed won’t intervene to “rescue” stocks (no Fed Put).

Position Trader Angle: Powell just told you: Don’t expect rate cuts unless things get ugly. If anything, volatility could increase — and the Fed won’t be your safety net.

🧠 TL;DR for Position Traders

- No pivot coming. Rates are steady for now

- Inflation risks are sticky, especially via tariffs and supply chain drag.

- Growth is cooling, but no hard landing yet.

- Fed is patient — but uncertainty (especially political + trade policy) is high.

- Tariffs, immigration, and credit market cracks are the stealth risks to watch.

🔐 Pro+ Extras:

Track 1# – Next Week

What’s Coming Up Next Week (Apr 21–25)

🇬🇧 UK Flash PMIs – Wed, Apr 23

Services PMI is forecast to slip to 51.4 (from 52.5). With rate cut bets simmering, this is a key sentiment signal for UK growth and monetary policy trajectory.

🇪🇺 Eurozone PMIs – Wed, Apr 23

Germany and France remain on the brink. Manufacturing at 47.4 and Services at 50.4 both signal sluggish activity. Not recession yet, but it’s close.

🇺🇸 Durable Goods Orders – Thu, Apr 24

Forecast at +1.5% MoM. A hot print would reinforce the sticky inflation narrative and keep upward pressure on yields. Risk-on assets might not like it.

🇺🇸 Jobless Claims – Thu, Apr 24

Expected at 215K — still tight. Another print like this keeps the Fed on edge. Any surprise uptick could soften bond yields.

🎤 Fed Speaker Blitz – All Week

Goolsbee, Waller, Kashkari, Jefferson, Harker, and Bailey are all on deck. Traders will be parsing tone and nuance for clues ahead of the June FOMC.

🔐 Pro+ Extras:

⇨ Most Anticipated Earnings Releases

(Including Tesla, Google)

🎧 Finished reading? Like this kind of curation?

📬 Get notified when the next weekly Playlist drops